Sa mga mag aaply or sa mga nakaaply na papuntang Canada may mga tips po sa baba na makakatulong sa inyo.

Ayon sa source ito ay sinulat ni Nestor de Quiroz ( No Link Available ) Sana makatulong etoh sa inyo.

1. SECURE a Manitoba Health Card and Social Insurance Number (SIN)

2. FILL UP application for gov’t / provincial credits and benefits (GST,CTB,UCB, MCB etc.)

3. SIGN UP for Life of Peg Association of Manitoba, Inc. / FIND a Church, Family Doctor, Your kid’s school.

4. CHOOSE a Canadian bank / credit unions:

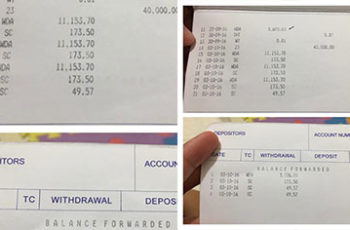

a. OPEN a Chequing account, preferably JOINT with spouse. Ask for Void

Cheque / Pre- Authorize Deposit (for employment purposes)

b. OPEN- Tax Free Savings Account (TFSA), Registered Educational Savings Plan (RESP). This can be managed by Investment Companies through Financial Advisors. Get a pre-authorized payment plan.

c. DEPOSIT ALL your settlement funds for paper trails. We have an Anti-Money Laundering Law. Kung ilalagay mo lang sa ilalim ng carpet, mahihirapan ka when it is about time for you to use it, say down payment for a house. Government will NOT tax you on that kung ilalagay mo sa bank other than the interest it incurred..

5. APPLY for a Credit Card: preferably JOINT with spouse

a. Utilize MAXIMUM of 50% of limit (ex. $1,000 limit, keep it to $500

balance).

b. Once you are employed for 6mos, apply for 2 more REVOLVING

ACCOUNTS (another Credit Card and/or Line of Credit), as long as the

total limit of ALL is at least $5,000.

c. REMEMBER: Discipline your self to use just 1 credit card. DO NOT Buy

things MORE than what you can afford. Bago ka pa lang para mabaon agad sa utang. MANAGE your finances….

d. NEVER MISS A PAYMENT or past due for even 1 day – Financial

Institutions can see late payments in your credit reports for 7 years, making it difficult to apply for bigger loans. Kung sa $500 sira kana, what more sa $30k n car loan or $180k na bahay… yun ang interpretation nila sayo…

6. REGISTER with MANITOBA START / Get your credentials assessed / Apply for a Driver’s License.

7. Find a job (kahit ano basta mag karoon ng employment history & reference).

– LEARN how to make a Canadian resume na fit sa ina applyan mo, kung ilalagay mo ung, MBA, PhD, Manager, VP etc. sabit ka kase over qualified ka & possible k pang maging threat sa position ng boss mo hehehe

8. LIFE INSURANCE.. Kahit term lang to protect your family. Hindi tayo naniniwala dito, kase sa atin isang malaking SCAM. It is a NECESSITY here in Canada!!! Lahat ng bagay naka insured….This can also be a MORTGAGE LIFE INSURANCE pag bili ng bahay later.

9. HELP your close relatives (SPONSORS) –

a. FINANCIAL: Huwag maging pabigat sa kamag anak…hehehehe. Kung

kumukita na tayo mag kusa na tayo na tulungan natin sila. Huwag sasama

ang loob kung parang sa tingin mo eh sinisingil ka. Hindi nag bago ugali ng kamag anak mo, gipit lang talaga sila.hehehe.. kase malaki ung

monthly mortgage, property tax, fire insurance, Autopac, tv, internet,

gas & electicity, water, grocery, masyado malaki. MAX OUT n rin ung Line

of Credit nila na ginamit mo pang SHOW MONEY mo. Mayaman lang sila tingnan s Facebook, ang totoo inutang lang nila yun ….LOL. Ibahin

natin dito compared sa Pinas, sa atin TABO lang dito kahit ung pamunas

ng pwet mo n tissue may bayad…. LOL… MINIMUM: $400 ($200 sa

utilities & $200 sa groceries) ang i share mo, depende sa laki ng family. Para maka pag DIMSUM nmn sila paminsan minsan. Ma realize mo lang ang mga ganito pag nag SOLO ka na. So habang nakatira ka sa

kanila makaka ipon ka pa dapat makaipon din sila..hehehe

b. SNOW REMOVAL / GARBAGE DISPOSAL/ HOUSEHOLD CHORES: Kamag anak natin double job na may under the table pa. Kaya sa pagod nde n nila magagawa mga ito.

c. COMMUNICATE: Hindi nababayaran ang UTANG NA LOOB, atleast, let

us make them feel na very thankful tayo na natulungan nila tayo (kahit

ayaw mo..hehehe), keep in touch with them often kung nakalipat n kayo.

d. KEEP YOUR PROMISE to live and settle in Manitoba – Wag muna tayo magmadali, antayin mo muna dumating ung huling inisponsoran bago mag paalam. Pag OK naman ang sponsor mo, pede ka na lumayas ng Winnipeg..hehehe

10. RENT – Get the contract under your name and your spouse’s. Pay rent ON TIME!!!. Don’t pay cash, use your own cheques and ask for receipts…….

11. UTILITIES – Get gas/ electric, cable, water, cellphone bills under BOTH names.

12. Pre-owned / New vehicle – Eventually, you will be planning to have one of the biggest investments of your life, a house. More often than not, huge car loans gets in the way of Mortgage Approvals. So kung pre-owned na maliit ang monthly mas maganda.

13. INVEST – Take advantage of Government REGISTERED investment vehicles like TFSA, RRSP, RESP. Consult your Financial Advisor to assess your INVESTMENT TOLERANCE and understand your investment options. REMEMBER: A Child Tax Benefit eh sa mga bata so ilagay natin sa RESP (educational plan) nila na tatapatan ng Government para lumaki, wag pang monthly payment ng bagong sasakyan.

14. BUYING A HOUSE. Wait 12 months bago mag decide bumili ng bahay. Dahil mataas na ang RENT, it is practical to purchase. If you are renting $1,000 a month. You are losing $12,000 a year, since nataas ang bahay ng $10,000 every year, you are losing $22,000 in TOTAL every year habang nag aantay ka. SAVE money for DOWN PAYMENT for your house para makakuha ka ng magandang deal sa interest rate. Hanggat maari huwag umutang para pang down sa another utang at huwag bibili ng bahay na hindi kakayanin ng budget, dapat i factor din ung pinapadala sa Pinas. Otherwise, mag water therapy k n lang, sandwich at banana na lang diet mo, sabagay mapipilitan ka maging healthy

Via : Pinoy-Canada